Getting My San Antonio Insurance To Work

Term life insurance lasts for a set variety of years. If you pass away before the term ends, it pays your designated recipient a set amount. Term plans are taken into consideration one of the most straightforward and also available type of life insurance policy. You pay when you get insurance coverage. When you die, your beneficiaries will certainly get the cash.

The cash worth can be utilized to purchase anything or use it for a financing - Find out more. Entire life protects you for the time you pay your life insurance costs. You could wish to buy whole life insurance policy if you need the cash value to cover points like endowments or estate strategies or if you have lasting dependents such as children with disabilities.

Yet, like with any kind of product, there are great and also bad points. An uncomplicated plan without any surprise fees, exemptions, or dangers, You can terminate your insurance policy prior to it expires as well as not lose any worth. The most affordable choice Does not end, The cash worth part is beneficial for individuals who want to prepare their estate.

Slow down to grow, Cash money Give up Value of the plan changes with time Universal life insurance coverage has a cash money value. The premiums for this most likely to the money worth and also the survivor benefit. So any kind of adjustments you make to what you pay or just how much death benefit there can occur without getting a new policy.

The 5-Minute Rule for Higginbotham Insurance

Still, the rate of interest aren't repaired or changed like various other long-term insurance policy strategies (san antonio insurance company). IUL, on the various other hand, generally has profits constraints, which means you might lose out on the revenues if the index surpasses the maximum enabled. Under IUL plans, every one of the exact same coverages are available as global life insurance plans.

It can include medical care, a funeral, or cremation. This insurance policy is for older people that do not have life insurance coverage.

Final cost insurance policies have a high rate. If you or your household can't spend for the funeral with other methods, that is the most effective option. Discover more About Last Expense Insurance coverage With streamlined problem life insurance policy, you do not need to experience a medical examination. Rather, you need to fill primerica life insurance up out a wellness questionnaire regarding smoking cigarettes behaviors and also serious health problems and carry out a phone interview with the underwriting team.

The Greatest Guide To Higginbotham San Antonio

Guaranteed problem life insurance policy uses them this coverage. It is various than the kind you purchase on your own. Many people think the life insurance coverage their employer offers is sufficient, but it could not be.

If you desire to guarantee your family members unum short term disability will be taken treatment of, this may not be enough. Company life insurance policy normally supplies low coverage, only enough to be worth one to 2 years of your salary.: Group Universal Life Insurance Coverage Since you know the various life insurance policy policies, it is time to choose which is best for you.

The three primary kinds are entire, global life insurance, as well as term life insurance policy. Term life insurance policy as well as permanent life insurance policy are the two major kinds.

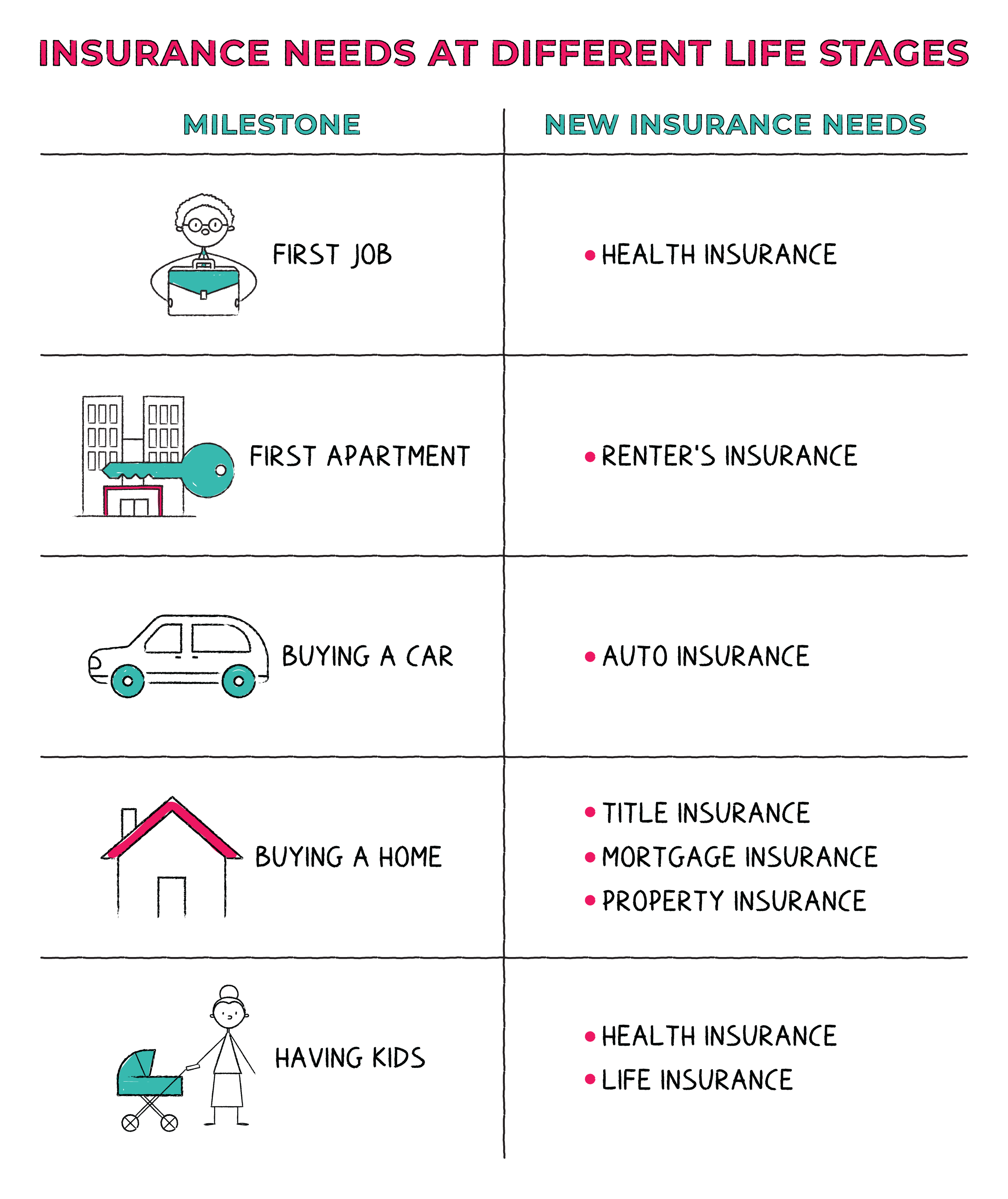

Exactly how do you recognize what types you need? Is it required by your state? Exist methods to conserve cash as well as still have the correct amount of protection? Listed below we detail 5 kinds of insurance coverages and supply a couple of situations where you would gain from having a non-required coverage added to your plan along with some ideas to save some cash relying on your automobile as well as budget. san antonio insurance company.

Getting The Higginbotham San Antonio To Work

Responsibility insurance policy will certainly cover the cost of fixing any kind of residential or commercial property harmed by a crash in addition to the medical costs from resulting injuries. Most states have a minimum requirement for the quantity of liability insurance coverage that motorists have to have. If you can afford it, nevertheless, it is you could try this out generally a great concept to have liability insurance that is above your state's minimum obligation insurance coverage need, as it will certainly provide extra protection in case you are located at fault for a crash, as you are accountable for any type of insurance claims that surpass your coverage's ceiling.

If there is a covered accident, collision insurance coverage will certainly pay for the fixings to your car. If your auto is amounted to (where the cost to repair it goes beyond the worth of the automobile) in a mishap, collision protection will certainly pay the worth of your cars and truck. If your auto is older, it may not deserve lugging accident coverage on it, depending upon the value.

Keep in mind: If you have a lienholder, this protection is needed. What if something happens to your auto that is unassociated to a protected mishap - weather damages, you struck a deer, your cars and truck is stolen - will your insurance coverage company cover the loss? Obligation insurance policy and crash coverage cover accidents, however not these situations.

Comprehensive protection is just one of those points that is fantastic to have if it suits your budget - Insurance agency in San Antonio. Anti-theft and tracking tools on cars and trucks can make this insurance coverage slightly a lot more economical, yet lugging this kind of insurance can be costly, and also might not be necessary, especially if your automobile is easily changeable.